Fixing the Disconnected World of Healthcare Payments (INFOGRAPHIC)

Brian Wallace, Founder & President, NowSourcing

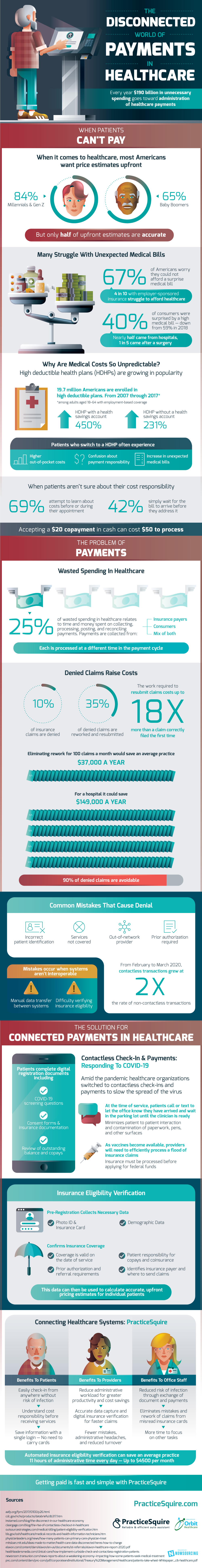

During COVID-19, collecting payments and going to the doctor has become increasingly complex. When it comes to healthcare, most Americans want price estimates upfront; 84% of Millennials and Gen Z and 65% of Baby Boomers want these price estimates, yet only half are accurate. Many Americans struggle with unexpected medical bills. Even with employer-sponsored insurance, 4 in 10 Americans struggle to afford healthcare.

Why are costs so unpredictable? Recently high deductible plans have increased in popularity; high deductible plans with a health savings account have risen 450% and plans without a health savings account have risen 231%. Almost 20 million American adults with employment-based coverage were enrolled in high deductible plans from 2007 through 2017. Even though 69% of patients attempt to learn about costs before or during their appointment, patients who switch to these insurance plans often encounter confusion about payment responsibility, higher out-of-pocket costs, and an increase in unexpected medical bills.

Medical payments can be collected from three sources: insurance payers, consumers, or a mix of both. All of these are processed at a different time in the payment cycle, complicating medical spending. One-quarter of all wasted spending in healthcare relates to the time and money spent on collecting, posting, and reconciling payments.

Denied claims also increase costs. 10% of insurance claims are denied; the work required to rework and resubmit can cost up to 18 times more than a claim that is correctly filed the first time. These are a source of potential money-savers, seeing as 90% of denied claims are avoidable. Eliminating rework for 100 claims per month would save the average medical practice $37,000 a year and could save a hospital $149,000. Common errors that lead to denial include incorrect patient identification, services not covered, out-of-network provider, or prior authorization required. Mistakes can also occur when systems are interoperable.

Contactless check-in, insurance eligibility verification, insurance card OCR, and connected systems can solve these spending issues. To slow the spread of COVID-19, contactless check-in and payments have been implemented across the country. Contactless check-in and payments minimize patient-to-patient interaction and the contamination of pens, paperwork, and other surfaces. Patients complete digital registration documents including COVID-19 screening questions, consent forms, and insurance documentation, and review of outstanding balance and copays.

PracticeSquire efficiently connects healthcare systems, making getting paid fast and simple. Benefits to insurance providers include reduced administrative workload, accurate data capture and digital insurance verification for faster claims, and fewer mistakes, administrative headaches, and reduced turnover. Patients can easily check-in from anywhere without the risk of infection, understand cost and responsibility before receiving their services, and save information with just a login. Office staff eliminate mistakes and rework claims from misread insurance cards, reduce their risk of infection, and get more time to focus on other tasks. PracticeSquire is the reliable and efficient auto assistant that benefits all.

Source: PracticeSquire

Source: PracticeSquire

About the Author:

Brian Wallace is the Founder and President of

NowSourcing, an industry leading infographic design agency in Louisville, KY and Cincinnati, OH which works with companies ranging from startups to Fortune 500s. Brian runs #LinkedInLocal events, hosts the Next Action Podcast, and has been named a Google Small Business Adviser for 2016-present. Follow Brian Wallace on Linked

About the Author:

Brian Wallace is the Founder and President of

NowSourcing, an industry leading infographic design agency in Louisville, KY and Cincinnati, OH which works with companies ranging from startups to Fortune 500s. Brian runs #LinkedInLocal events, hosts the Next Action Podcast, and has been named a Google Small Business Adviser for 2016-present. Follow Brian Wallace on Linked