Fighting Against Home Title Fraud (INFOGRAPHIC)

Brian Wallace, Founder & President, NowSourcing

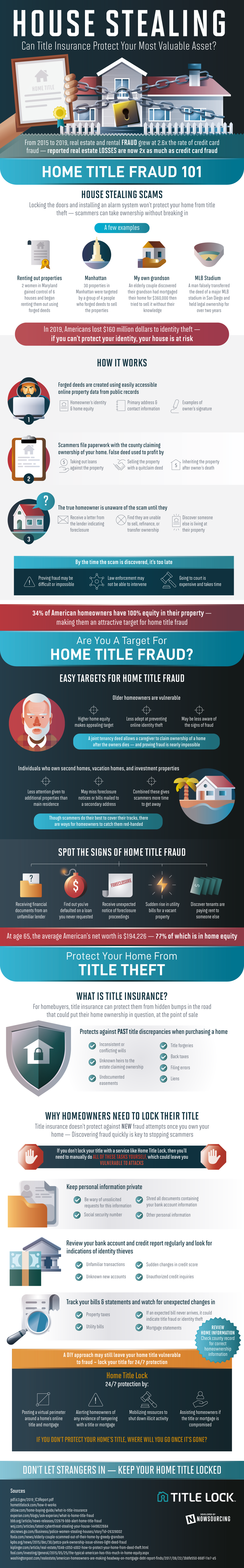

For most Americans, equity in their home is their greatest asset. Unfortunately, not all homeowners are taking the necessary precautions to protect their asset from being stolen. Locking the door and installing an alarm system won’t keep scammers from stealing a home’s title. Thieves can take ownership of a house without ever breaking in. This sort of theft is becoming more common, as well; from 2015 to 2019, real estate and rental fraud grew at 2.6x the rate of credit card fraud. It can happen to any homeowner too. In one heartbreaking case, an elderly couple learned that their own grandson had mortgaged their home and attempted to sell it without their knowledge.

How do scammers steal properties they don’t own? First, they create forged deeds using easily accessible online property data from public records. Next, they file paperwork in the county of the residence falsely claiming ownership of the home. Most often, they do this to take out loans against the property, sell it using a quitclaim deed, or inherit the property after its true owners’ death. Once an honest homeowner is made aware of the scam, it is often too late. Proving fraud runs from difficult to impossible, law enforcement may not be able to intervene, and going to court is expensive and takes more time than many people have. Most vulnerable to home title fraud are elderly homeowners and those who own more than one property (think vacation homes, investment properties, and the like).

Luckily, there are several steps homeowners can take to prevent title fraud. Title insurance protects homebuyers from past title discrepancies when purchasing a home. While this is useful at the point of sale, it does not offer protection against new fraud attempts. Instead, homeowners must stay vigilant. They must keep personal information private, review bank accounts and credit reports regularly, and watch for unexpected bills or mortgage statements. Also useful is checking county records to confirm correct homeownership information.

One service that does all the above tasks for their customers is Home Title Lock. Home Title Lock offers 24/7 protection by keeping watch over a home’s online mortgage and title, alerting homeowners of tampering, and mobilizing resources to shut down illicit activity when it happens. Protecting a home’s title is vital because many would have nowhere to go once it’s gone.

So don’t let strangers in. Keep your home’s title locked.

Source: HomeTitleLock.com

Source: HomeTitleLock.com

About the Author: Brian Wallace is the Founder and President of

NowSourcing, an industry leading infographic design agency in Louisville, KY and Cincinnati, OH which works with companies ranging from startups to Fortune 500s. Brian runs #LinkedInLocal events, hosts the Next Action Podcast, and has been named a Google Small Business Adviser for 2016-present. Follow Brian Wallace on Linked

About the Author: Brian Wallace is the Founder and President of

NowSourcing, an industry leading infographic design agency in Louisville, KY and Cincinnati, OH which works with companies ranging from startups to Fortune 500s. Brian runs #LinkedInLocal events, hosts the Next Action Podcast, and has been named a Google Small Business Adviser for 2016-present. Follow Brian Wallace on Linked