Examining the IRO as CCIO (Chief Competitive Intelligence Officer)

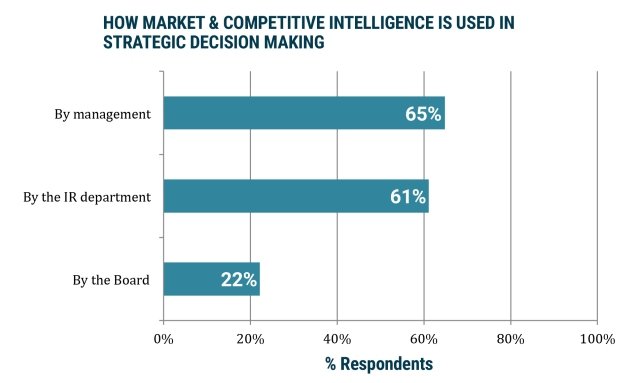

As the pace of transformation across almost every sector continues at an unprecedented rate, the prerequisite to make sense of developments and gain perspective on what’s next has never been more important.Investor relations departments, positioned among the most strategically important flows of information, have a unique opportunity to execute this imperative role by focusing competitive intelligence gathering with an eye to its effectiveness, efficiency and strategic impact.

As the pace of transformation across almost every sector continues at an unprecedented rate, the prerequisite to make sense of developments and gain perspective on what’s next has never been more important.Investor relations departments, positioned among the most strategically important flows of information, have a unique opportunity to execute this imperative role by focusing competitive intelligence gathering with an eye to its effectiveness, efficiency and strategic impact. Certainly, IROs have always been denizens of the capital markets competitive intelligence, due to intelligence portals such as Bloomberg and ThomsonOne as well as the 13-F data so smartly served by firms like Ipreo.Greg Secord, vice president of investor relations at Ontario-based software company OpenText Corp, takes a collaborative approach to competitive intelligence that extends the company’s reach and understanding and keeps him on top of trends he might not otherwise be aware of when talking with analysts and investors.Strategic impact is why Secord argues IR is the natural home for competitive intelligence. Within his four-person group, he has one analyst responsible for monitoring the news stream across the Bloomberg terminal on behalf of the entire company. Because this responsibility resides within IR, his group can do more than just distribute data. By continuously monitoring what competitors are telling investors and how the financial markets perceive competitive positioning across the industry, his group is in a unique position to add strategic context. ‘We are so tied in to corporate strategy, we can identify if something changes that may be close to our strategy or may be completely different,’ he says. While it may be a subtle difference, Secord argues that the ability to add context is ‘important at the highest level ‒ that’s how you take the noise out.’

Certainly, IROs have always been denizens of the capital markets competitive intelligence, due to intelligence portals such as Bloomberg and ThomsonOne as well as the 13-F data so smartly served by firms like Ipreo.Greg Secord, vice president of investor relations at Ontario-based software company OpenText Corp, takes a collaborative approach to competitive intelligence that extends the company’s reach and understanding and keeps him on top of trends he might not otherwise be aware of when talking with analysts and investors.Strategic impact is why Secord argues IR is the natural home for competitive intelligence. Within his four-person group, he has one analyst responsible for monitoring the news stream across the Bloomberg terminal on behalf of the entire company. Because this responsibility resides within IR, his group can do more than just distribute data. By continuously monitoring what competitors are telling investors and how the financial markets perceive competitive positioning across the industry, his group is in a unique position to add strategic context. ‘We are so tied in to corporate strategy, we can identify if something changes that may be close to our strategy or may be completely different,’ he says. While it may be a subtle difference, Secord argues that the ability to add context is ‘important at the highest level ‒ that’s how you take the noise out.’

Continue reading here on BEYOND PR.